Process large transactions efficiently with lower fees and better cash flow control with Sensapay's ACH processing services.

SensaPay’s ACH lets you move high-value payments directly between banks, process recurring or bulk transactions in one batch, and track every transfer in real time. With our ACH services, you get:

Lower Transaction Costs

Keep more of your revenue with zero interchange fees and reduced overhead on high-value payments.

Enhanced Security & Compliance

Protect sensitive data with bank-level security, fraud detection, and adherence to ACH regulations.

Streamlined Operations

Simplify payment workflows, reduce manual tasks, and speed up batch processing without extra resources.

Our ACH platform combines cost savings with enterprise functionality. Here's what sets our processing capabilities apart from standard solutions:

How Businesses Use ACH for Smarter Transactions

ACH transfers work best when transaction amounts justify the processing method and timing requirements align with your business operations. These scenarios maximize the value of bank-to-bank transfers:

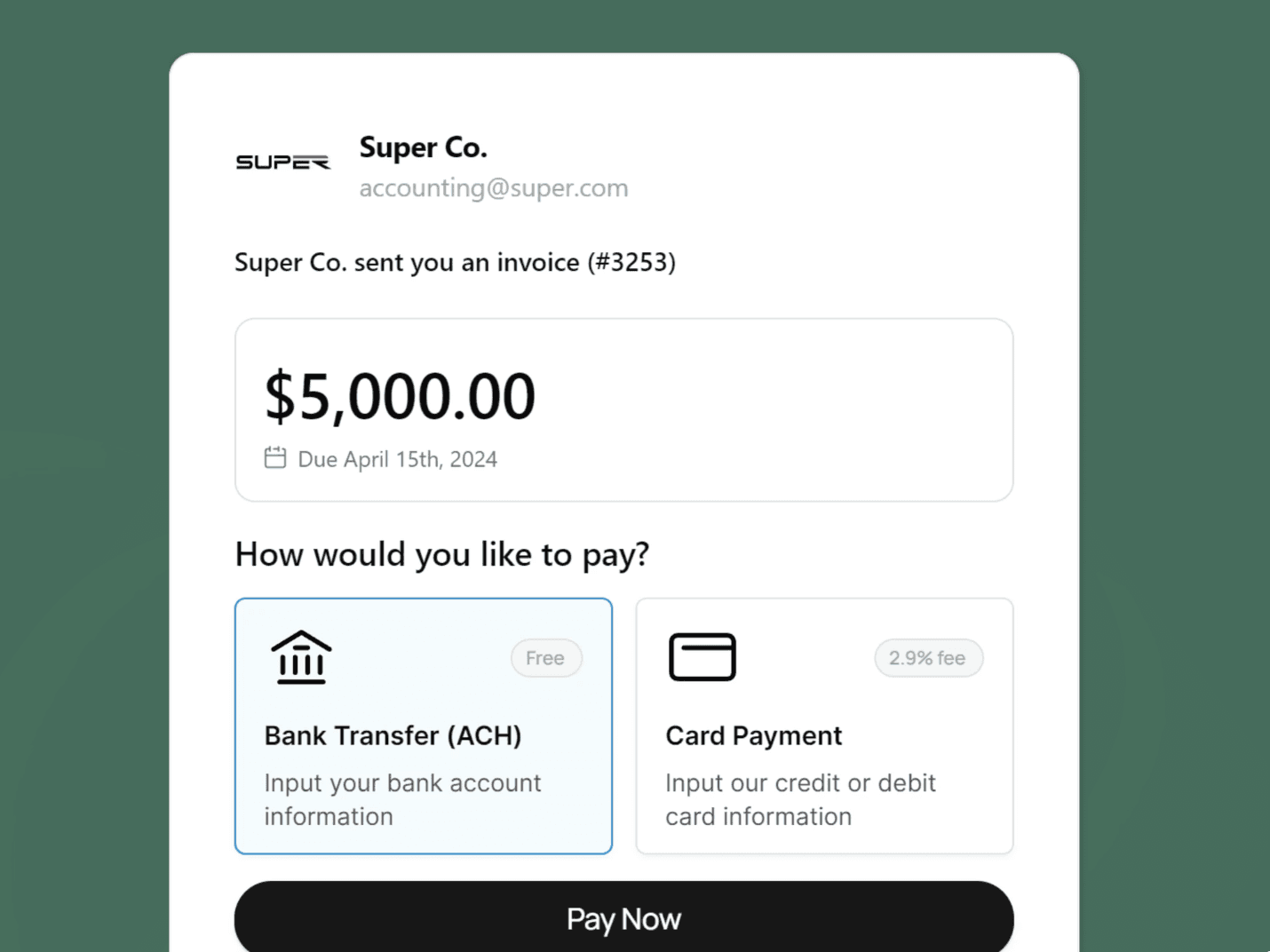

Collect payments directly from bank accounts without cards or checks. ACH is part of the SensaPay platform so you can manage it alongside other payment types in one place. Here is how it works:

1

Customer Approval

The customer provides bank details gives permission to pull money from their bank account, so the payment is secure and authorized.

2

Payment Processing

The request goes through the ACH network. Banks verify and process it, handling multiple payments in batches for efficiency.

3

Funds Settlement

Once approved, the money moves from the customer’s account to yours. This usually takes one to a few business days.

4

Tracking and Reconciliation

You can see every payment in your dashboard, match it to invoices, track pending and completed transfers, and keep your records accurate.

Optimize Your Payments With ACH

Simplify how you collect money, reduce delays, and keep every transaction organized so your business runs smoother.