Accept online, in-app, and in-person payments with speed and security.

Get Started

99.9%

Uptime Guarantee

500ms

Average Processing Time

98%

Fraud Detection Rate

24/7

Customer Support

Payment gateways connect your business to the networks that handle customer payments. When these fail, revenue stops flowing. The impact of gateway problems:

Gateway downtime and slow processing halt online sales and create abandoned carts when customers won't wait.

Security vulnerabilities in outdated infrastructure expose your business to data breaches and compliance violations.

Security vulnerabilities in outdated infrastructure expose your business to data breaches and compliance violations.

Sensapay's gateway eliminates these problems with reliable infrastructure, instant processing, and comprehensive security.

Sensapay's payment gateway addresses payment processing challenges through purpose-built technology designed for modern businesses.

Redundant servers with automatic failover ensure continuous availability. Optimized infrastructure processes transactions in milliseconds, reducing cart abandonment.

Complete Payment Method Support

Accept credit cards, debit cards, Apple Pay, Google Pay, and ACH transfers through one integration. Customers pay their preferred way without additional development work.

Simple Integration & Enterprise Security

Pre-built plugins for major platforms and flexible APIs for custom setups. Advanced encryption and fraud detection operate invisibly without affecting transaction speed.

How SensaPay helps your business grow and succeedHow SensaPay helps your business grow and succeedHow SensaPay helps your business grow and succeedHow SensaPay helps your business grow and succeed

Unified Transaction Processing

Handle online, in-app, and in-person transactions through one unified interface.

Complete Payment Method Support

Accept credit cards, debit cards, ACH bank transfers, and digital wallets without separate integrations.

Smart Transaction Routing

Automatically optimize transaction routing for higher approval rates and lower costs.

Easy Platform Integration

Connect instantly with Shopify, WooCommerce, and 20+ other platforms through pre-built plugins.

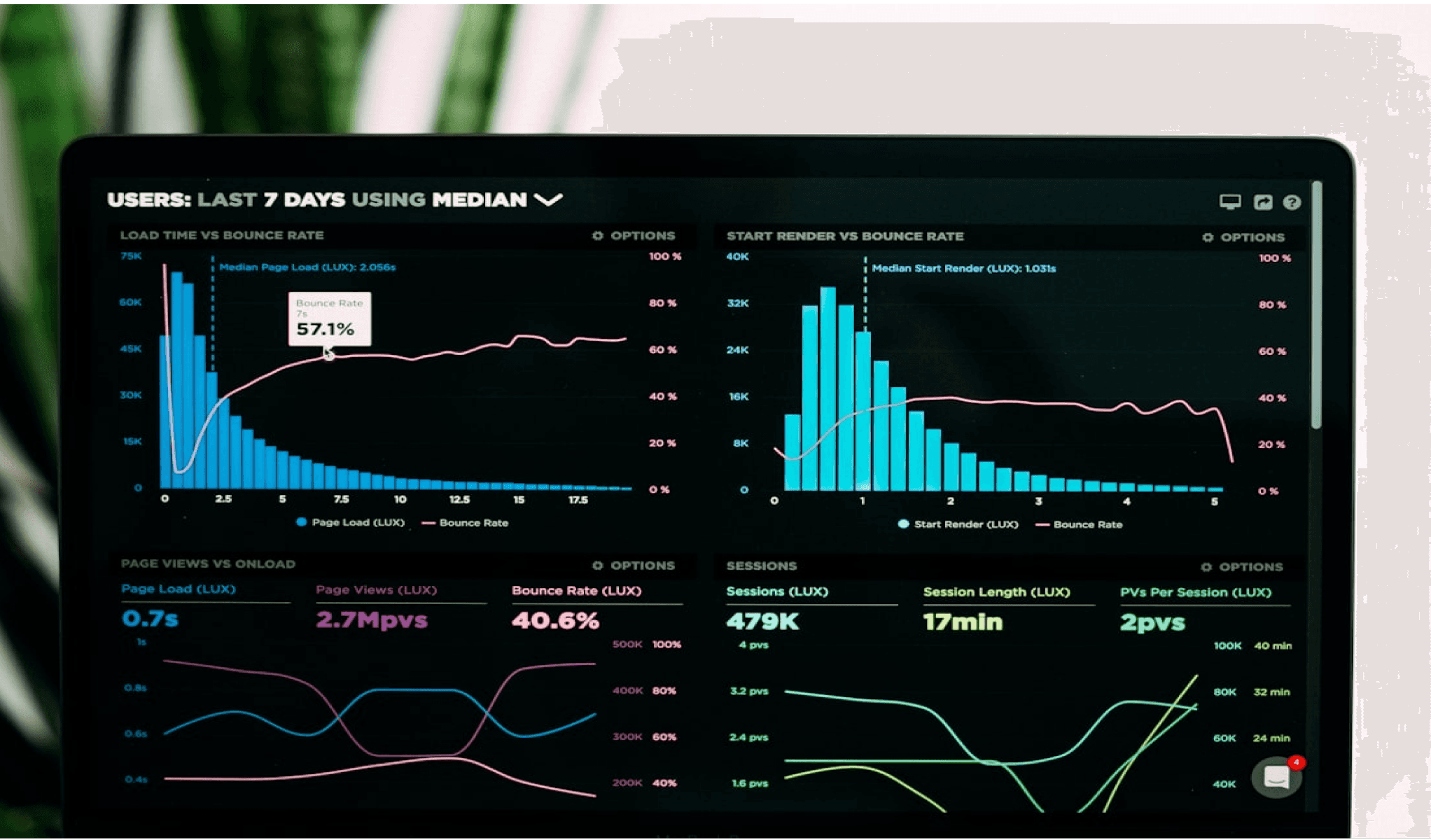

Comprehensive Analytics

Detailed reporting with transaction logs and performance metrics.

Customizable Checkout Experience

Branded payment pages and forms that match your website design while maintaining security compliance.

Improve approval rates and minimize payment friction with tools that streamline transaction processing.

Smart Retries

Recover more revenue by trying failed payments again when they're most likely to succeed.

Interchange Optimization

Automatically qualify transactions for lower processing rates based on the specific card type.

Account Updater

Keep subscriptions active by automatically refreshing stored card details when customers get new cards.

Our chargeback management system resolves disputes while applying proactive measures to prevent them.

To protect every transaction, payments are first screened with AVS for authenticity, then evaluated with machine learning and 3D Secure to detect fraud early. You also have the option to customize fraud rules to fit your risk strategy, ensuring control over how payments are monitored.

Also, clear billing descriptors make it easy for customers to recognize charges and avoid confusion.

Beyond basic payment processing, SensaPay provides additional features to grow your business

Advanced Analytics

Gain insights into your payment data with detailed reporting and customizable dashboards.

Smart Retry Logic

Automatically retry failed transactions with intelligent timing to maximize success rates.

Fraud Prevention

Advanced machine learning algorithms detect and prevent fraudulent transactions in real-time.

Global Payments

Accept payments in 135+ currencies with localized payment methods for international customers.

Get started with SensaPay in just a few simple steps

1

Sign Up

Create your account and complete the verification process

2

Integrate

Use our APIs, SDKs, or pre-built plugins for your platform

3

Test

Use our sandbox environment to test your integration

4

Go Live

Activate your account and start processing payments

Up to 40%

Fewer Chargebacks

Stop disputes before they start with proactive fraud detection.

3x Faster

Resolution Times

90%

Automated Responses

Skip the manual work with our intelligent response system.

Prevent Disputes and Protect Revenue

Maximize wins and minimize losses from disputed payments.

Real-Time Fraud Alerts

When you receive a chargeback, you are notified immediately via email/SMS.

Evidence Submission

Automatically generate and send documentation, saving time and reducing errors.

Customizable Rules

Tailor alerts, thresholds, and workflows to your business needs.

Actionable Insights

Analyze patterns, track recovery, and optimize your payment strategy.

Streamline Payments and Reduce Risk Today

Stop losing sales to payment processing problems. SensaPay's gateway gives you the reliability and speed your business needs to grow.