Accept credit cards, ACH, or digital wallets, whatever your customers prefer. SensaPay provides tailored merchant payment processing services to match your industry, risk level, and transaction volume.

Secure Transactions

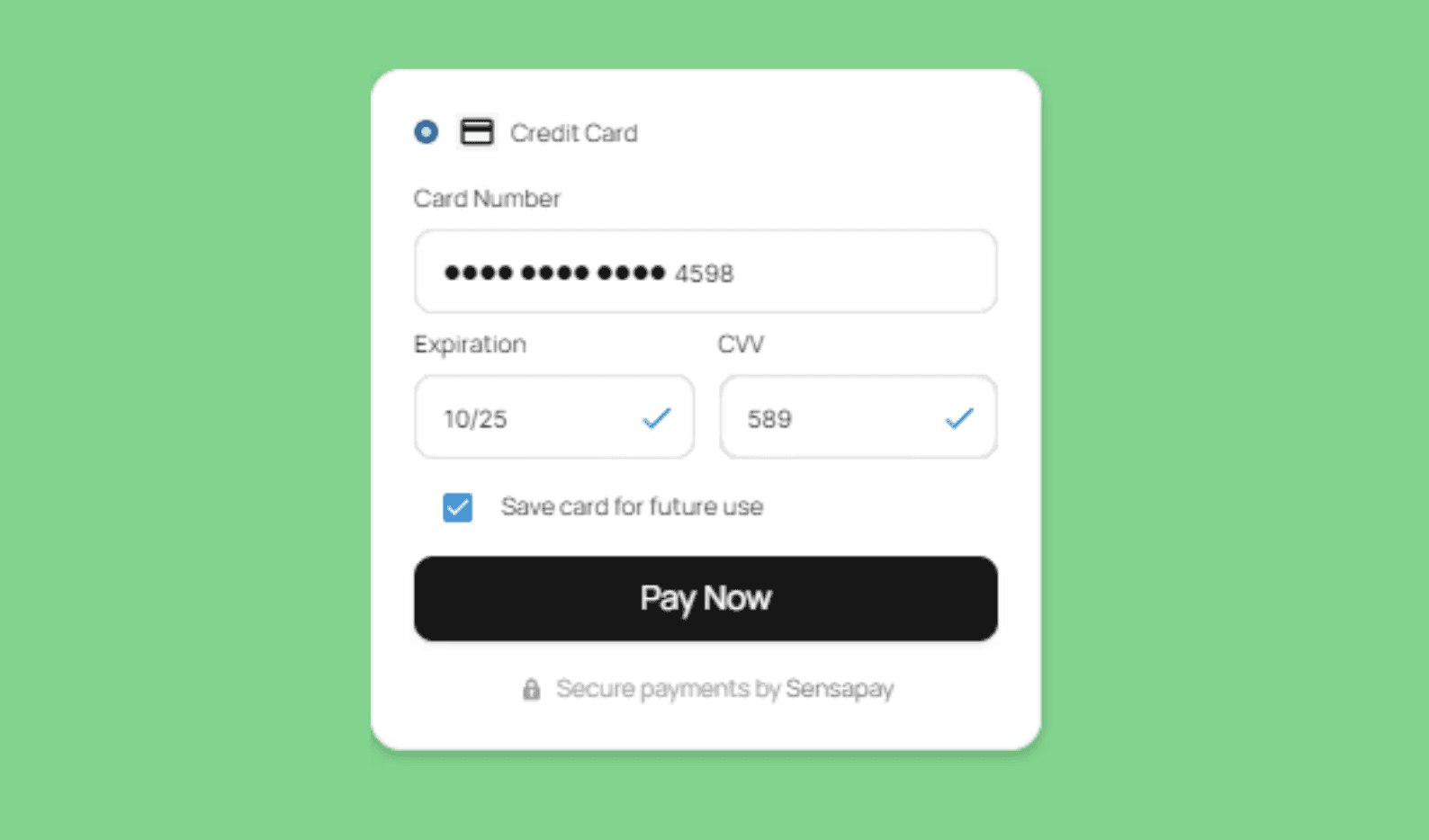

Run payments through encrypted channels and PCI-compliant systems.

Speedy Payouts

Get paid faster with settlement timelines that keep your cash flow moving.

No Hidden Fees

Keep all fees transparent and make smarter decisions for your business

Accept and Process Payments Effortlessly

SensaPay enables your business to accept a wide range of payment methods, ensuring flexibility and security for both you and your customers.

When customers hand you a card at checkout, you need processing that's quick, secure, and simple. SensaPay's card-present solutions include POS systems, countertop terminals, and mobile card readers designed to work wherever you do business.

EMV chip and contactless payments for faster, safer in-person transactions

Mobile card readers that turn your phone or tablet into a payment terminal

Integrated POS systems that sync sales data with inventory and accounting tools

Selling online, over the phone, or through recurring subscriptions? Card-not-present transactions require extra security and flexibility. SensaPay gives you the tools to accept payments remotely while minimizing chargebacks and fraud.

eCommerce integrations with popular platforms like Shopify, WooCommerce, and Magento

Virtual terminals for processing phone or mail orders from any device

Recurring billing systems that automate subscription payments and reduce manual work

SensaPay connects online, in-person, and mobile transactions within one unified ecosystem. Customer pays through your website? At your store counter? Via a mobile app? All payment data flows into a single merchant account with consistent processing rules and reporting.

SensaPay equips you with smart tools to optimize payment performance, prevent fraud, and keep your finances in order.

SensaPay supports businesses across different sectors and risk profiles. Traditional retail to high-growth digital markets. Our underwriting and gateway systems adapt to each sector's compliance requirements, risk characteristics, and transaction volume patterns.

Partner with a Reliable Payment Processor

Process payments quickly with merchant services built around how you operate. Contact our team to discuss your payment acceptance needs.