From choosing the right provider to leveraging ACH payments, these actionable strategies will help you keep more of your hard-earned revenue.

Slash Your Credit Card Processing Fees: Insider Tips Every Merchant Needs to Know

Evan Lo

June 17, 2024

Credit card processing fees can be a significant expense for small businesses, often eating into profit margins more than expected. For small business owners looking to maximize their profitability, finding ways to reduce these fees is crucial.

This guide is designed to provide you with actionable tips and insider strategies to help you minimize your credit card processing costs and improve your bottom line. Whether you're just starting out or looking to optimize your existing operations, these tips will help you keep more of your hard-earned revenue.

Tips Outlined

Pick the right provider and pricing model for your business

Don’t rent your device. Own it.

Save with fee saver

In-person transactions cost less

ACH is your friend

Review your statements

Encourage debit - but you can’t force it

Gather complete customer data online

Minimize chargebacks

Batch process transactions

Pick the Right Provider and Pricing Model for Your Business

Choosing the right payment processor is crucial for managing your credit card processing fees. Different providers offer various pricing models, and understanding these options can help you select the best fit for your business.

When comparing payment processors, consider these two main pricing models:

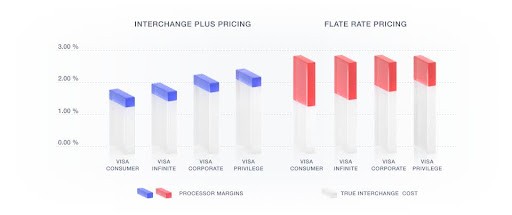

Interchange Plus: This model offers transparency by breaking down the fees, showing you exactly what the card networks charge and how much your processor adds on top. This clarity allows you to see the processor markup and ensures you understand the true cost of each transaction.

Fixed Rate: A fixed rate provides simplicity and predictability, making it easier to budget for your transaction costs. This model can be beneficial for businesses with lower transaction volumes or those that prefer straightforward, consistent pricing without the need to monitor varying interchange rates.

Finding the right balance: While negotiating fees is possible, significant reductions are rare, and some providers may require a contract for minimum processing volumes to keep the low rates. If merchants don't meet this requirement, they may need to pay extra fees. Therefore, it's important to choose a provider known for fair pricing and good customer support from the start. Look for processors that offer clear fee structures and align with your business needs, whether you prefer the transparency of interchange plus or the simplicity of a fixed rate. The goal is to find a balance between reasonable costs and reliable service.

Scenario:

Imagine you run a small retail business with a high volume of low-value transactions. In this case, a payment processor that offers a fixed rate such as Square might be more beneficial because it provides predictable costs and simplifies budgeting. However, if you’re a service provider and your business processes high-value transactions, an interchange plus pricing model such as what Sensapay provides might be more advantageous. This model could save you money as it typically has a lower markup for higher-value transactions, offering greater transparency and potential savings.

Don’t Rent Your Device. Own It.

Leasing a payment terminal might seem like the more attractive option in the short-term, but in reality, it’s more expensive in the long run. Purchasing your own device eliminates monthly rental fees and gives you greater flexibility. Additionally, some processors, like Moneris, require a contract for their services, meaning you may be locked into renting the device for years. This can result in higher overall costs than initially expected.

This isn’t to say that there aren’t situations where leasing might be the better option. For example, if you run a small business from home but are planning to attend a trade fair, you might need hardware to accept payments temporarily. In such cases, leasing a device for a short period can be more practical and cost-effective. However, for most businesses, owning your terminal provides long-term financial benefits and flexibility, allowing you to avoid restrictive lease agreements and unexpected costs.

Scenario:

Imagine you lease a payment terminal for $30 a month from Moneris. Over their three-year contract, you’ll pay $1,080. In contrast, purchasing a Smart Terminal from Helcim costs $399. By buying the device, you save $681 over three years and avoid recurring monthly expenses. This significant saving underscores the long-term financial benefits of owning your equipment.

Save with Fee Saver

Some payment processors offer "fee saver" programs that allow businesses to pass credit card processing fees to their customers. This means that instead of the business absorbing the cost of transaction fees, the customer pays a small percentage at the time of purchase.

Why fee saver is beneficial: Lower Processing Costs: By transferring the transaction fees to customers, businesses can significantly reduce their overall processing costs.

Enhanced Profit Margins: This approach helps businesses maintain their profit margins without having to increase product prices to cover processing fees.

Scenario

Imagine a business that processes $20,000 in credit card transactions monthly, paying 2.9% in fees, which totals $580. By implementing a fee saver program, the business can pass these fees to customers, effectively saving $580 each month, or $6,960 annually.

If you're looking to optimize your expenses, it's worth asking your provider about available fee saver options. For example Helcim offers fee saver to their merchants. Exploring these options can lead to significant savings without changing your pricing structure.

In-Person Transactions Cost Less

Whenever possible, encourage customers to pay in person. In-person transactions generally have lower fees compared to online or manually keyed-in transactions.

Why are in-person transactions cheaper?

Lower risk of fraud: In-person transactions involve the physical presence of both the card and the customer, making it easier to verify the authenticity of the payment method. This physical verification reduces the risk of fraudulent activities. Payment processors view in-person transactions as less risky compared to online or manually keyed-in transactions, which are more susceptible to fraud. Lower risk typically translates to lower processing fees.

Advanced security features: In-person transactions make use of advanced security features like EMV chips and contactless payments (NFC). These technologies add an extra layer of security by generating unique transaction codes for each payment, making it difficult for fraudsters to clone cards or steal card information. Due to these enhanced security measures, processors often offer lower fees for in-person transactions.

Reduced processing costs: Online transactions require additional security measures such as tokenization, encryption, and fraud detection services, which increase the overall processing costs. In contrast, in-person transactions do not require these additional layers of security, resulting in lower fees.

Scenario:

Consider a retail store where customers frequently pay using chip-enabled cards. If they use Square, the processing fee for these in-person payments might be around 2.65% of the transaction amount. Conversely, if the same store processes an online payment, the fee could be as high as 3.4% due to the increased risk and additional security measures required for online transactions. Over time, these fee differences can add up significantly, impacting the store’s profitability.

How to encourage in-person transactions:

Promote in-store experiences: Highlight the benefits of shopping in-store, such as immediate product availability, personalized customer service, and exclusive in-store promotions.

Offer incentives: Provide discounts or loyalty rewards for customers who choose to pay in person. This can be an effective way to drive foot traffic and reduce transaction fees.

Streamline checkout process: Ensure that the in-person payment process is quick and convenient. Invest in modern, user-friendly payment terminals to enhance the customer experience and minimize wait times.

By encouraging in-person transactions, businesses can take advantage of lower processing fees, improve security, and enhance customer satisfaction. This strategy not only helps in reducing costs but also fosters stronger relationships with customers through direct interactions.

ACH is Your Friend

Automated Clearing House (ACH) payments are a cost-effective solution for recurring payments and other types of transactions. This system processes payments electronically through a network, bypassing traditional card networks and reducing associated fees. For example, paying your monthly utility bill through direct debit from your bank account is an ACH transaction. However, ACH can also be used to pay invoices, making it a versatile payment option. Educating your customers about ACH payments can save on transaction fees and enhance payment efficiency.

Why ACH payments are beneficial:

Lower Transaction Fees: ACH payments involve direct bank transfers, bypassing card networks and their fees, which can save significant money on recurring transactions. ACH fees are typically lower and capped at around $6 per transaction, making it an excellent option for businesses with high-volume transactions.

Improved Cash Flow: ACH payments provide predictable revenue streams since they are scheduled for specific dates. This predictability aids in better financial management and planning.

Reduced Declined Payments: ACH transactions draw directly from bank accounts, reducing the risk of declines compared to credit card payments, which can be affected by expiration dates or credit limits.

By utilizing ACH payments for both direct debits and invoice payments, businesses can lower their transaction costs, improve cash flow, and reduce the likelihood of declined transactions.

Scenario:

A gym with 200 monthly memberships at $50 each can save around $240 per month by switching from credit card payments (2.9% fee) to ACH payments (0.5% fee). Here’s the breakdown:

Credit card fees: 200 memberships x $50 x 2.9% = $290 ACH fees: 200 memberships x $50 x 0.5% = $50 Monthly savings: $290 - $50 = $240

Note that this calculation is exclusive of any flat rates or interchange plus fees that may be applied on top of the processing fee.

Review Your Statements

Regularly reviewing your statement can help you identify errors, unexpected charges, and rate increases. For businesses that sell both in-person and online, reviewing your statement can help you discover the average rates that you need to pay for your total revenue.

If you have a concern about your high rate, you can use Helcim’s statement comparison tool to estimate the total fees you can save when you use Helcim.

Benefits:

Idenitfy errors: Spot discrepancies such as incorrect fees or misapplied charges.

Detect unexpected charges: Stay aware of additional fees or new terms introduced by your processor.

Monitor rate increases: Track changes over time and assess their impact on costs.

Scenario

Consider a small business that processes a significant number of transactions monthly. By using a statement comparison tool, the business can review its statements each month, ensuring that the fees charged align with the agreed-upon rates. In one instance, the tool helps identify an unexpected rate increase that went unnoticed for several months. By catching this discrepancy early, the business addresses it with the processor, securing a refund for the overcharges and preventing future rate hikes.

How to Implement:

Choose a tool that integrates with your processor and offers clear reports. Helcim offers a reliable statement comparison tool that can help with this.

Review statements monthly to catch any changes.

Act promptly on any discrepancies to resolve issues with your processor.

Using a statement comparison tool ensures accurate and manageable processing fees, leading to potential savings.

Encourage Debit – But You Can’t Force Customers

Debit card transactions often have lower fees than credit card transactions. While you can't force customers to use debit, you can inform them about the benefits.

Benefits of encouraging debit card use:

Lower processing fees: Debit card transactions generally have lower fees because they draw funds directly from a customer's bank account, reducing the risk for payment processors.

Reduced risk of chargebacks: Debit transactions have a lower risk of chargebacks since funds are immediately deducted from the customer's account.

How to encourage debit card use:

Educate customers: Inform customers about the benefits of using debit cards, such as avoiding interest charges.

Offer incentives: Provide discounts or loyalty points for customers who pay with debit cards.

Scenario

Imagine a coffee shop where the average transaction is around $5. Credit card fees might take a significant portion of these small transactions. By encouraging customers to use debit cards, the shop can reduce processing costs and improve its profit margins. For example, if the coffee shop processes 100 transactions a day and shifts even half of those to debit, the savings on fees can be substantial over time.

Minimize Chargebacks

Chargebacks are an inevitable part of doing business but they can be minimized. To minimize them, implement clear return policies, provide excellent customer service, and ensure all transactions are transparent and well-documented. Helcim offers tools such as Fraud Defender and Chargeback Management to help merchants prevent and counter chargebacks. The Fraud Defender provides an estimation of risk based on an analysis of seven transaction factors, allowing merchants to make informed decisions before completing a sale. The Chargeback Management feature helps merchants submit evidence and navigate the resolution process effectively.

Why you should avoid chargebacks:

Time-consuming dispute process: Dealing with disputes and countering chargebacks consumes a lot of time. You would have to gather evidence, submit it, and track the resolution process, diverting attention from running the business.

Impact on cash flow: When a chargeback occurs, the payment processor typically holds the disputed funds for investigation. This can negatively impact your cash flow and cause frustration as you wait for the issue to be resolved.

High volume risks: Sudden high transaction volumes or new merchants processing large volumes from the beginning can trigger fund holds by the processor. This is done to investigate the legitimacy of the transactions, leading to more frustration and potential delays in accessing your funds.

By understanding and mitigating the risks associated with chargebacks, you can focus on growing your business with fewer interruptions and financial setbacks. Implementing strong customer service practices and maintaining transparent transaction records are key steps in reducing chargebacks and their associated challenges.

Scenario

Consider an online store operating in a high-risk industry like eCommerce, which often receives numerous online orders and faces a high rate of chargebacks. To mitigate this risk, Helcim Fraud Defender helps evaluate each transaction and provides a risk score before the merchant ships the order. This tool allows the merchant to avoid losing products and the associated headaches of chargebacks.

Additionally, when a chargeback occurs, merchants can use Helcim's chargeback counter feature to submit evidence and navigate the resolution process effectively. By utilizing these tools, the store can significantly reduce the number of chargebacks, defend against claims more effectively, and maintain better relationships with customers.

By implementing these practices and leveraging Helcim's tools, you can minimize chargebacks, reduce related fees, and protect your business from financial setbacks.

Gather Complete Customer Data Online

Collecting complete customer data during online transactions can help reduce fraud and qualify for lower interchange rates. When you gather comprehensive information such as billing address, phone number, and email, it enhances the security of the transaction. Payment processors use this data to verify the transaction's authenticity, reducing the risk of fraud. Additionally, transactions with more detailed customer data are often eligible for lower interchange rates because they are deemed less risky.

Scenario:

Consider an online store that requires only minimal information at checkout, like name and credit card number. This store is more susceptible to fraudulent transactions, resulting in higher processing fees. In contrast, an online store that collects complete customer data, including billing address, phone number, and email, can better prevent fraud and may qualify for lower interchange rates. This comprehensive data collection helps in reducing overall processing costs.

By ensuring you gather complete customer data, you not only protect your business from fraud but also take advantage of lower interchange rates, thereby saving on transaction fees.

Batch Process Transactions

Batch processing refers to closing out and submitting the day’s credit card transactions to the processor. Doing this daily can help avoid higher fees associated with late settlements and speed up fund deposits. This practice also speeds up the deposit of funds into your bank account, improving cash flow and financial management.

Scenario:

Imagine a business that processes credit card transactions throughout the day but only submits them once a week. This delay can lead to higher fees and slower access to funds. By switching to daily batch processing, the business can avoid these additional fees and receive their funds faster, enhancing their overall cash flow. By adopting daily batch processing, you can reduce fees, ensure quicker access to your funds, and streamline your financial operations. This simple change can have a significant positive impact on your business’s bottom line.

By following these tips, you can effectively reduce your credit card processing costs and boost your profitability. Start implementing these strategies today to take control of your expenses and enhance your business' financial health.